The union budget 2026 was presented on 1 February 2026 by finance minister Nirmala Sitharaman. This is a historic moment for India’s economic roadmap for fiscal year 2026-2027.The Union Budget 2026 highlights reflect the Government’s effort to make India a more investment-friendly, compliant, and globally competitive economy.

The union budget 2026 is a blueprint for India’s India’s socio-economic progress. This blog breaks down the Budget 2026 key highlights that matter most to businesses, NRIs, and taxpayers.

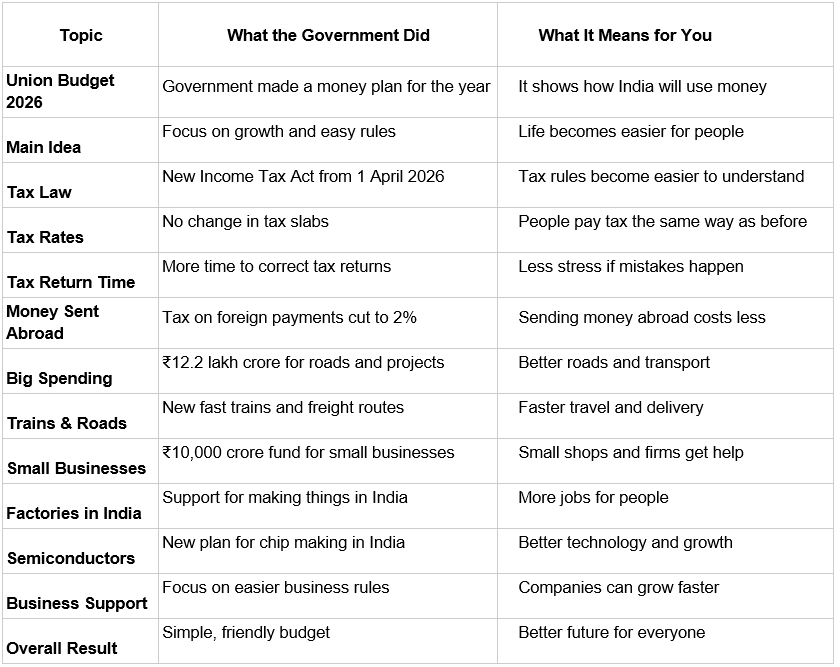

• Tax & Compliance Reforms: Simplification and Relief

An important goal of the Union Budget 2026 was to simplify India’s tax regime and reduce compliance burden for everyone.

• Income Tax Act 2025 Coming Into Force

One of the most impactful moves was the announcement that the Income Tax Act 2025, will replace the existing law from 1 April 2026. the aims to reduce the number of sections, remove outdated provisions, and make compliance more clear.

• No Change in Tax Slabs

The finance minister confirmed no change in income tax slabs for FY 2026–27 for salaried tax payers, hence providing a lot of stability.

• Extended Return Revision Window

The Budget also extended timelines for taxpayers to revise income tax returns. This helps in giving a lot of stability and reducing stress.

• Reduction in TCS for Overseas Payments

Money sent outside India for travel, studies, or medical treatment will now have much less tax taken.The tax is now only 2%, which is lower than before. A relief for global transactions came with a reduction in Tax Collected at Source (TCS).

An important aspect of Union Budget 2026 highlights is an increase in focus on infrastructure, innovation, and business environment enhancement.

1. Record Capital Expenditure

The government announced an impactful captal expenditure allocation of ₹12.2 lakh crore for FY 2026-27 almost a 9% increase from the previous year reaffirming infrastructure as a key growth engine.

2. Infrastructure Expansion

Multiple major infrastructure initiatives were-

• Seven high-speed rail corridors linking key urban and economic hubs such as Mumbai-Pune, Pune-Hyderabad, and Delhi-Varanasi, aimed at faster and greener connectivity.

• Dedicated freight and rare earth mineral corridors to strengthen supply chains and support high-tech manufacturing.

This focus on infrastructure not only drives job creation but also lays the foundation for more efficient logistics and increase in competitiveness across business sectors.

The Budget also proposed a ₹10,000 crore SME Growth Fund to nurture small and medium enterprises (MSMEs), expand their scale, and improve access to credit and technology.

Strategic Sector Support

Strategic sectors such as electronics manufacturing semiconductors received a lot of attention.

India Semiconductor Mission 2.0 was announced to accelerate domestic semiconductor production, boost research, and attract global partnerships

Overall, the Business-focused policies in the Union Budget 2026 signal a clear intention to push Indian industry towards higher value-added growth.

The Union Budget 2026 key highlights also include a lot of provisions aimed at enhancing investment opportunities and easing compliance for NRIs.

1) Higher Investment Limits

The Budget raised the equity investment limit for individual Non-Resident Indians and Persons Resident Outside India (PROI) in listed Indian companies:

● From 5% to 10% for individual NRIs.

● From 10% to 24% for overall sectoral caps — expanding opportunities for overseas portfolio investment.

2) Foreign Asset Disclosure Scheme

To help NRIs and globally mobile taxpayers address legacy compliance issues, the Budget introduced a one-time six-month foreign asset disclosure window. This allows eligible taxpayers to declare previously undisclosed foreign assets without harsh penalties.

The reduction in TCS rates on overseas education and medical remittances lowers the immediate tax burden for NRIs and families with global financial commitments.

This mix of relaxed limits, compliance windows, and tax relief makes India more attractive to global Indian investors and professionals.

The Union Budget 2026 successfully combines ambitious infrastructure and sector growth plans with pragmatic tax and compliance reforms. For businesses, it reinforces India’s infrastructure and manufacturing potential. For NRIs, it unlocks higher investment ceilings and eases compliance burdens. And for taxpayers, it brings relief in filing, clearer TDS/TCS rules, and reduced friction on global remittances.

Key reform measures, strategic investments, and fiscal discipline encapsulate the Budget 2026 key highlights that will influence India’s economy in the years to come. As we move into FY 2026–27.