Budget day is the most anticipated event for the people of India for both business purposes and to understand the schemes and initiatives of the government that could potentially benefit them. Recently on July 23, the honorable finance minister took the parliament stage and announced the union budget 2024-25. The introduction of the union budget 2024-25 focussed majorly on the agriculture sector and the introduction of schemes related to employment, loan schemes, announcement of financial support to the MSME sector, infrastructure development, and much more. The union budget announced by the Smt. Nirmala Sitharaman is based on the themes of next-generation reforms, aiming to boost economic growth and productivity, enhancing the efficiency of the market and sectors. The budget aims to promote competitive and sustained economic processes in the country and guide the nation's development era. The budget is also termed as one of the most vital elements (roadmap) for the country's development over the next five years. It is one of the key aspects to heal the GDP growth this year between 6.5% to 7%(as per the economic survey of 2024).

However, the key points of the budget 2024 are highlighted below in the article. So, for the key points of budget 2024, make sure to follow the whole article.

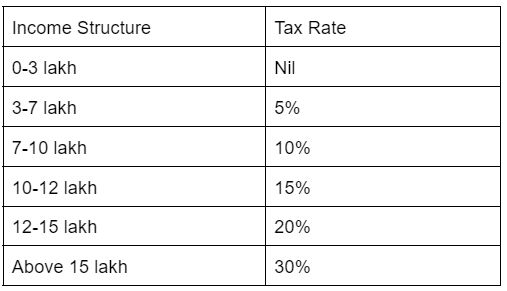

Changes in Tax Structure Under the New Regime

These are the new taxation slabs introduced in the recently announced union budget by the honourable Finance Minister of India. As per the above changes in the tax regime, it should be noted that the salaried employee can save upto Rs. 17, 500 in taxes.

Direct Tax Proposals

The introduction of the direct tax proposal benefits enhancing the limit of the standard deduction and family pension deduction under the new regime. The new regime of standard deduction has been increased to Rs. 75,000 from Rs. 50,000. Similarly, the deduction in the family pension has been increased to Rs. 25,000 from 15,000.

Corporate Taxes on Foreign Companies

Under the new union budget, the corporate taxes are imposed directly on the company’s net income or profit. The budget for 2024 reduces the corporate tax on foreign companies by 5% from 40% to 35%.

Other Direct Tax

Reopening of ITR: The reopening of ITR is only imposed if the income is Rs 50 lakh or more can be assessed to be reopened beyond three years from the end of the assessment year.

Income Tax Appeals It is imposed to reduce the number of pending cases. The limit for filing tax dispute appeals in high courts, and supreme courts has been raised to upto Rs.2 crore.

Agriculture: In the union budget 2024, priority has been given to the agriculture sector where the government has made provision of Rs.1.52 crore for the agriculture and agriculture allied sectors. It is assumed to initiate 1 crore farmers in the industry by 2026. The government aims to promote farmer organisations, startups, and vegetable supply chains including storage, collections, and marketing.

Employment and Education: Under the government schemes of employment and education, the government will implement 3 new schemes based on the EPFO enrolment which will provide a direct benefit transfer. Employee and the employer will be facilitated through an incentive based on the EPFO contribution based in the first 4 years of employment. The government also added a scheme to reimburse employers based on the EPFO contribution. Any student can avail of loans of up to Rs.7.5 lakh with the Model Skill Loan Scheme.

Human Resource Development: In the union budget 2024, the government has funded Rs. 2.66 lakh crore for the development of infrastructure in the rural areas including the eastern region of India like Jharkhand, Bihar, Odisha, West Bengal, and Andhra Pradesh. The government will formulate a plan for the development of rural areas and the development of industrial nodes. The government will also work on road connectivity and will handle power projects including the setting up of a MW power plant for Rs. 21,400 crore. The government also aims to launch a new scheme called Pradhan Mantri Janjatiya Unnat Gram Abhiyan to improve the infrastructure of tribal communities.

The union budget the Viksit Bharat Includes the Poor, women, youth, and farmers for the next generation of reforms. The budget has proposed different changes in the tax slab under the new tax regime. So, if you want to know detailed information about the changes in the tax structure in different sectors, must visit CA. Manoj K. Pahwa. The prominent team shares all the valuable information that attracts tax rates while addressing individual queries.