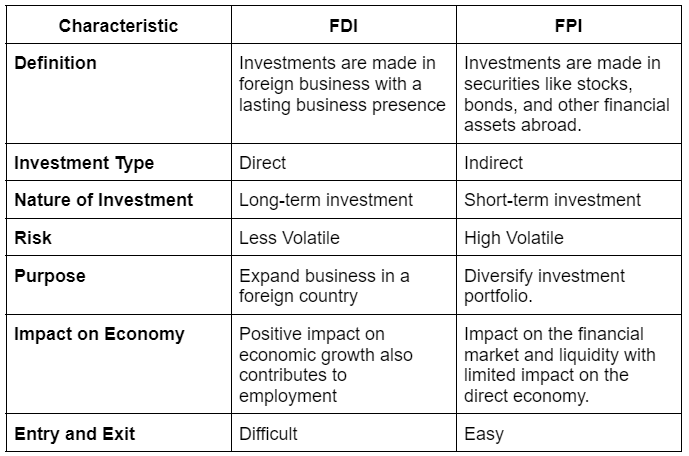

Capital has a vital role in the economic growth of every country and it can’t be raised from the domestic source alone. There are 2 common paths to expand business horizons beyond the domestic boundaries to meet the total capital requirement. The paths are Foreign Direct Investment(FDI), and Foreign Portfolio Investment(FPI). The investment made by an individual or firm in a direct business interest in a foreign country is termed Foreign Direct Investment while any investment from another country in the purchase of securities and other financial assets such as stocks is Foreign Portfolio Investment. These two methods are essential in establishing fair communication in investing in foreign capital by countries, especially developing nations. However, both FDI and FPI represent critical pathways for overseas investment but significantly differ in intent, influence, and investment.

Delving into the article will help in understanding both the terms Foreign Direct Investment(FDI) and Foreign Portfolio Investment(FPI) individually and understanding their unique definitions, characteristics, and motives.

The investment made by an individual or firm into a direct business interest in a foreign country such as buying or establishing a manufacturing business or building houses is referred to as Foreign Direct Investment . FDI involves acquiring an interest in a foreign country through the flow of capital, technology, and knowledge. FDIs are usually managed by the top MNCs, large institutions, or venture capital firms. FDI contributes to the development of both the investor and host countries by fostering the global economy. Since FDI is considered less volatile than the FPI, it is more favourable for long-term investment.

The investment made by an individual, institution, or firm in financial assets such as stocks, bonds, and other financial assets of a foreign country is referred to as Foreign Portfolio Investment. FPI generally involves a short-term strategy to invest money into the overseas country for a quick return. FPI can be easily bought or sold, contributing to the high volatility and less favourable than Foreign Direct Investment. Furthermore, it is only an approach by the investor focussing on quick financial returns rather than taking control of the company or direct management.

FDI and FPI are the two major ways to bring foreign investment into the domestic economy. The investment potentially benefits the global economy. FDI contributes to job creation and technology transfer but requires commitment while FPI offers flexibility and diversification in investment portfolio but with high risk. So, to take an investment call on FDI vs FPI, it depends on several economic factors and objectives such as political instability, currency exchange risk, risk tolerance, and market condition. So, it is always advised to consult with a financial advisor before making any investment in the foreign market. Choose the best FEMA consultant in Delhi , CA. Manoj K. Pahwa , to get relevant information on overseas investment and make informed decisions.